colorado springs sales tax online

Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail. In Colorado services are not subject to sales tax.

There are a few ways to e-file sales tax returns.

. Most Colorado sales tax license types are valid for a two-year period and expire at the end of each odd-numbered year. Please call the office to determine the cash deposit amount before mailing. Your browser appears to have cookies disabled.

As far as sales tax goes. Our mailing address is. Colorado Springs is located within El Paso County Colorado.

After you create your own User ID and Password for the income tax account you may file a return. This is the total of state county and city sales tax. Ad Lookup Sales Tax Rates For Free.

State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs. City of Colorado Springs Department 2408 Denver CO 80256-0001 Online Services instructions additional forms amended returns are available on our website. City of Colorado Springs Sales Tax Contact Information.

If you filed online or with a tax software and want to pay by check or money order. Salestaxcoloradospringsgov Web Address. 15 or less per month.

Sales tax returns may be filed annually. The license fee is 2000. 719 385-5291 Email Sales Tax Email Construction Sales Tax.

Recent Colorado statutory changes require retailers to charge collect and remit a new fee. Payment After Filing Online. Sales Use Tax System SUTS State-administered and home rule sales and use tax filing.

Colorado Springs CO 80903. Box 1575 Colorado Springs CO 80901. What is the sales tax rate in Colorado Springs Colorado.

Filing frequency is determined by the amount of sales tax collected monthly. Sales Tax Division PO. Cookies are required to use this site.

The current total local sales tax rate in Colorado Springs CO is 8200. Sales Tax Rates in the City of Glenwood Springs. Interactive Tax Map Unlimited Use.

The December 2020 total local sales tax rate was 8250. Sales Tax Filing and Payment Portal. Welcome to the City of Colorado Springs.

719-385-5291 Investigator Line. Annual returns are due January 20. Make the check or money order payable to the Colorado Department of Revenue.

City of Colorado Springs Department 2408 Denver CO 80256-0001 Online Services instructions additional forms amended returns are available on our website. File Sales Tax Online. Within Colorado Springs there are around 51 zip codes with the most populous zip code being 80918.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

Business Resources Colorado Springs

Covid 19 Response Colorado Springs

Red Rocks South 8 000 Seat Outdoor Amphitheater Planned In North Colorado Springs Pikes Peak Courier Gazette Com

1521 N Weber St Colorado Springs Co 80907 Mls 9573524 Zillow Colorado Springs Real Estate Colorado Springs Colorado

Colorado Springs Dangles 16 Million Incentive To Lure Outdoor Retailer Scheels Business Gazette Com

&lng=-104.7993&lat=38.9419&zoom=16&density=@2x&style=467fa4b0-55da-478c-8da5-2f314d596335&width=500&height=250)

Baby Toddler And Kids Clothing Store In Colorado Springs Co Carter S Colorado Springs

401 E Del Norte St Colorado Springs Co 80907 Colorado Springs Del Norte Colorado

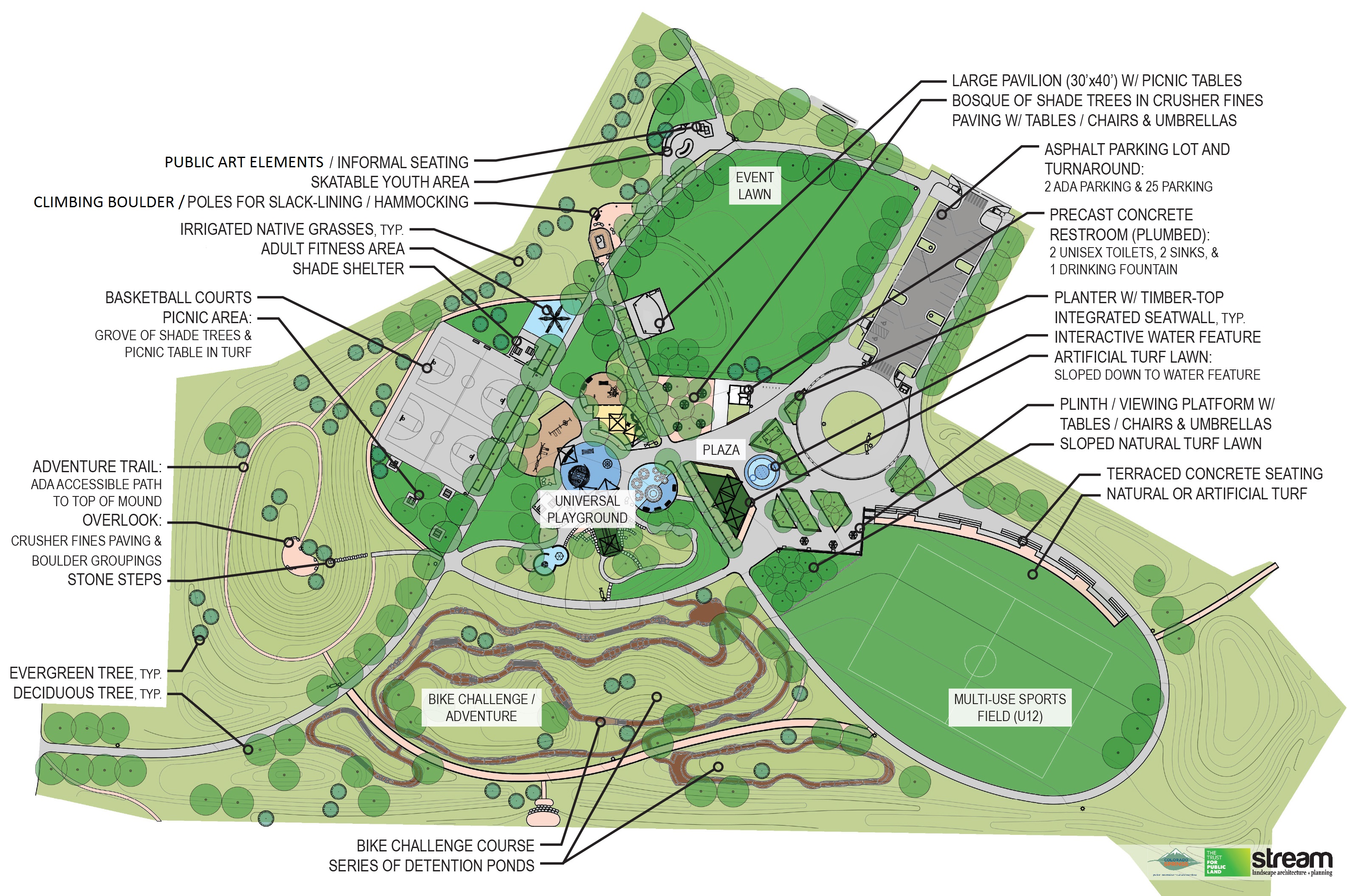

Panorama Park Renovation Colorado Springs

Office Of Innovation Colorado Springs

Taxes In Colorado Springs Living Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Colorado Springs Cost Of Living Colorado Springs Co Living Expenses Guide

South Nevada Avenue Colorado Springs Urban Renewal Authority

Colorado Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Biketobizcos Week Colorado Springs

New Downtown Parking Rates And Hours Go Into Effect Colorado Springs