flow through entity tax break

This legislation was passed as a. This means that the flow-through entity is responsible.

Ca Federal Income Tax Deduction For Pass Through Entities

Is elected and levied on the Michigan portion of the.

. The law signed by Whitmer on Dec. Understanding What a Flow-Through Entity Is. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

The limitation on how. There are three main types of flow-through entities. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

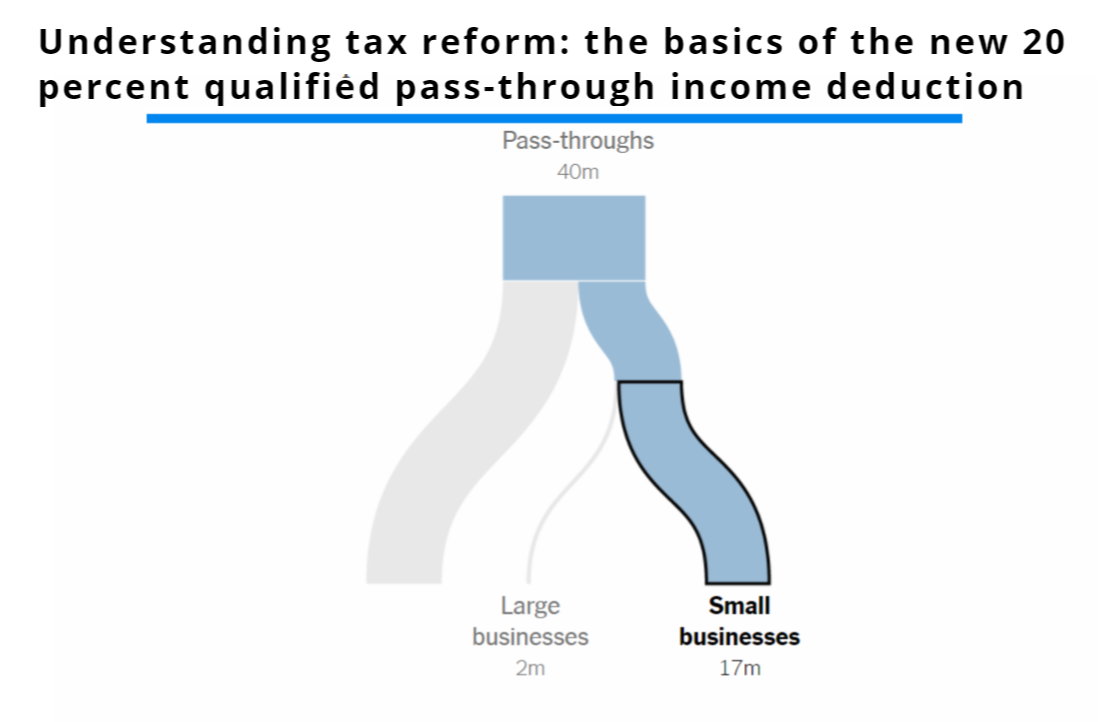

That is the income of the entity is treated as the income of the investors or owners. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a. Most small businessesand quite a few larger onesare set up as pass-through entities.

The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under. A business owned and operated by a single individual. Many small businesses are set up as flow.

In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. The Inflation Reduction Act which Senate Democrats passed on Sunday would extend a tax limitation on pass-through businesses for two more years. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

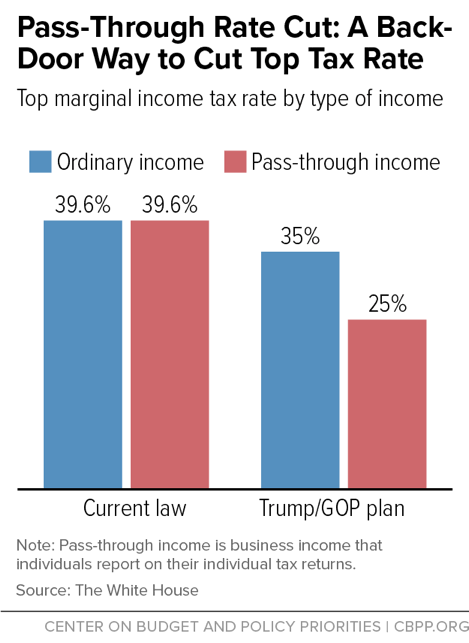

Instead all income of the business is passed through to the owners who report it on their personal income tax return and pay taxes at their effective marginal rate. Governor Whitmer signed HB. For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation.

Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan. However the late filing of 2021 FTE returns will be accepted as. 20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan.

Nearly 3 million more business owners claimed a 20 tax deduction on their income last year relative to the prior filing season according to IRS data. This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the. Flow-through entities are considered to be pass-through entities.

Types of flow-through entities.

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

Six Tax Effective Strategies For Small Businesses

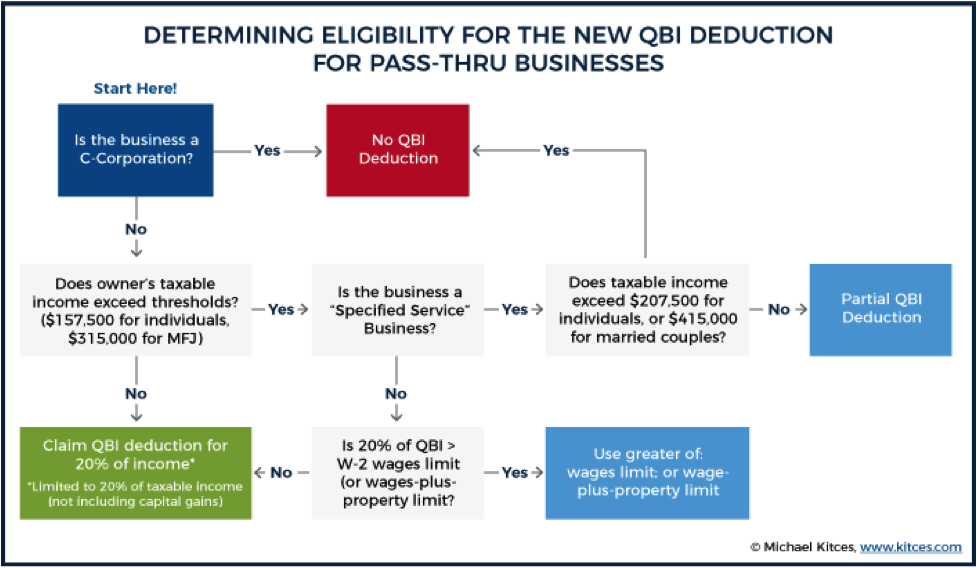

Navigating The Tcja S Pass Through Deduction Tax Policy Center

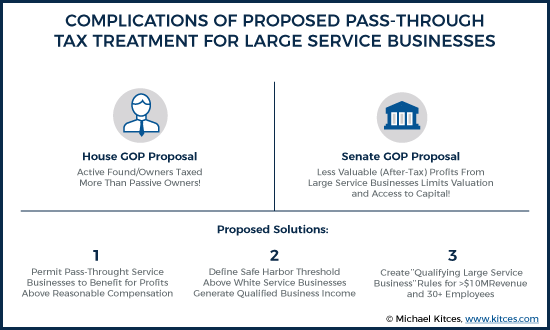

Proposed Pass Through Rules Distort Large Service Businesses

Irs Permitting Pass Through Entity Salt Deduction Workaround

Recent California Legislation Provides Tax Relief To Pass Through Entities Mize Cpas Inc

New Law Affects Pass Through Businesses With Pugh Cpas

Tax Deduction Limits And The Pass Through Entity The Staffing Stream

The New York Pass Through Entity Tax Election Freed Maxick

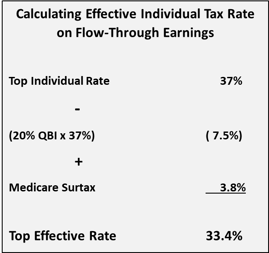

What The Gop S Final Pass Through Tax Cut Means For Business Owners

Pass Through Entity Tax Ptet Salt Deduction Workaround Longer Version Youtube

New 20 Tax Deduction For Pass Through Business Income Parkworth Wealth Management

How Business Owners Can Qualify For The New 20 Tax Deduction Windgate Wealth Management

Everything You Need To Know About Small Business Taxes The Hell Yeah Group

Choosing A Business Entity How The 2017 Tax Law Changed The Math

Tax Reform S Implications Of The 20 Pass Through Entity Income Section 199a

Qbi Deduction Provides Tax Break To Pass Through Entity Owners

Breaking News Governor Murphy Signs Bait Cleanup Legislation Sobelco

Republican Leadership Tax Plan S Pass Through Tax Break Would Provide Massive Windfall To The Wealthy Center On Budget And Policy Priorities